This post was sponsored by Anthem Blue Cross as part of an Influencer Activation for Influence Central and all opinions expressed in my post are my own.

Healthcare is so very important for us to have. It’s also important that you understand your healthcare options and you are ready at open enrollment! We get it’s the busiest time of year and you have 100 things on your to-do list. You put off enrolling for healthcare until last minute and then you’re forced to choose a plan not understanding what you are getting. This year place it at the top of your list.

I have seen people think they had a specific plan only to find the plan they chose wasn’t right for them or their family. There are a lot of government mandates that can affect plans each year along with other reasons for change. It’s necessary to educate yourself so you don’t get slapped with a medical bill you weren’t prepared for. I am an advocate for Anthem Blue Cross because I worked there years ago (loved it) and saw first hand the beneficial plans they offered. I was able to help people like you take charge of their health coverage, which made a huge difference in their life.

Why Should You Have Healthcare

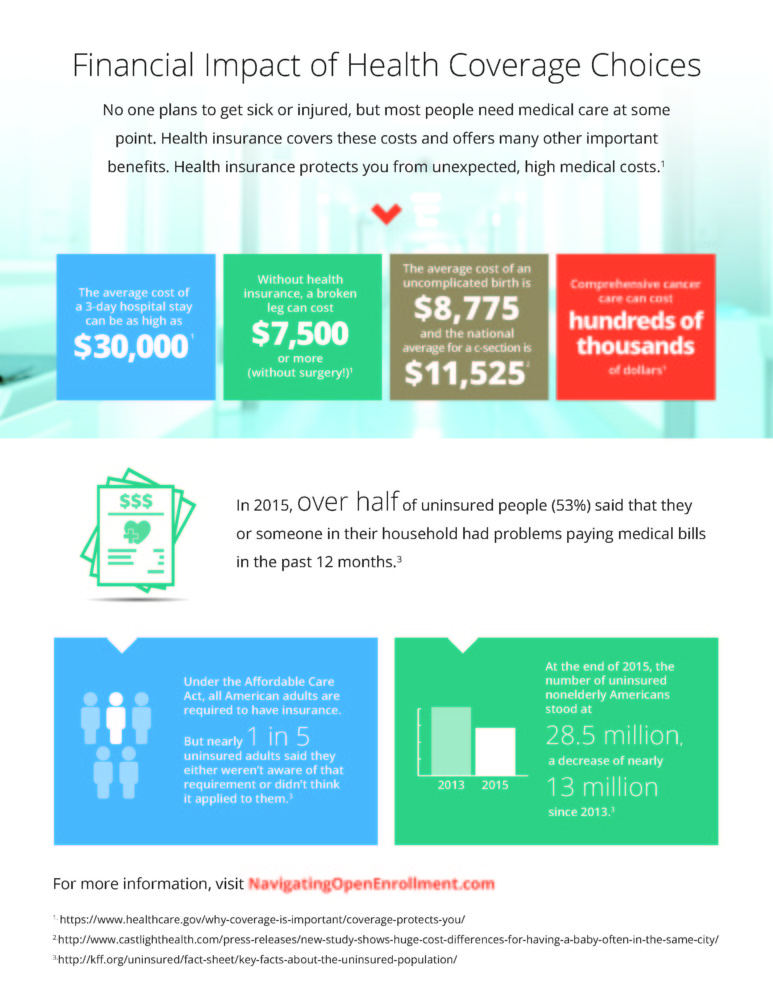

We never think it will happen to us. Unexpected medical issues can arise at any time, which can turn our life upside down. Our attention should be on the care, and not worrying how we’re going to pay for a procedure or doctor visit.

It’s So Confusing

Navigating health insurance and the healthcare system can be confusing, especially when plans are changed.

Not Confusing Anymore

Anthem Blue Cross has an abundance of information and experts to help you navigate your way through healthcare plan decisions and materials. Health insurers such as Anthem Blue Cross and Application Assisters, Navigators and brokers in your local communities are available to help you navigate your options during open enrollment season. For more information, go to navigatingopenenrollment.com or HealthCare.gov

Stay Healthy

There are many plans that help you stay healthy which in turn keeps money in your pocket. Most preventive visits are covered at 100%. Keep up with your visits and you will be taking charge of your health. Always be sure to check to see if there are “other” benefits. I have seen plans with discounts to gyms among other specialized health and wellness programs.

Know The Definitions

Knowing the definitions in your healthcare plan can make a difference on what you may choose. If you’re not sure what something means, ask! Here are a few common terms you should know:

- CoPay (CoPayment)- This is a flat fee that you pay. (EX: $20 copay for every doctor visit)

- Co-Insurance – This is a percentage you pay toward the medical expense (EX: 20% of the total bill)

- Allowable Charge – This is important to understand. This is what your insurance company allows the doctor or facility to charge. EX: The actual fee from a doctor could be $150. The insurance company allows the doctor to charge $80. If you have a copay, you would pay that, but if you had co-insurance you would pay 20% of the $80, NOT the $150.

- Deductible- A deductible is what you have to pay out of pocket. You may have to meet a deductible before the insurance company starts paying.

EX: You have a deductible of $500 then the insurance company will start paying 80%.

The doctor billed for $2000, the allowed amount is $1500. You would pay the first $500 from the $1500 then you would only pay 20% of the balance of $1000

- Health Savings Account (HSA) – A personal savings account that allows you to pay for medical expenses with pre-tax dollars. I suggest going over your option with this in detail with the person assisting you

- In-Network – This means doctors and facilities that are a part of an insurance company’s network. In other words they have contracts with the insurer to give you care. They also have agreed upon the “allowable charges.”

- Out-Of-Network- You want to try to always stay in network. An out of network provider (doctor) or facility does not have a contract with the insurance company. They basically can bill their actual fee, which can be much higher and you will be responsible. There are occasions when an insurance company will let you go to an out of network doctor.

I hope these definitions helped you. Please start thinking about your health insurance, and reach out to an expert and get your questions answered. Don’t wait until the last minute!

Have a Safe, Happy, and Healthy New Year!!!

What challenges do you have when choosing a healthcare plan?

Leave a Reply