The new year makes us think of fresh starts. We often use this time to change something we’re doing that isn’t in our best interest. The top changes are Exercise, Quit smoking, Get organized, and Get out of debt. None of these are easy if you’re in a bad routine. So how can you get a fresh financial start with Payoff and what is it? What small changes can you make to see big rewards? How will you spend your fun money? Me? I’m going to Key West- meet me there!

What is Payoff

Payoff is a financial services company, designing products that help people pay off their credit cards faster and save money. Through a combination of understanding who people are and what motivates them with our unwavering desire to see customers succeed, we are committed to the mission of restoring humanity to financial services.

How can Payoff help get a fresh financial start?

Payoff gives you a loan to eliminate your credit cards faster and save thousands of dollars by consolidating your high interest card balances into affordable, flat monthly payments, for 2-5 years (your choice). Let’s face it, you’ll be paying on your credit cards for years and probably thousands more than you should be!

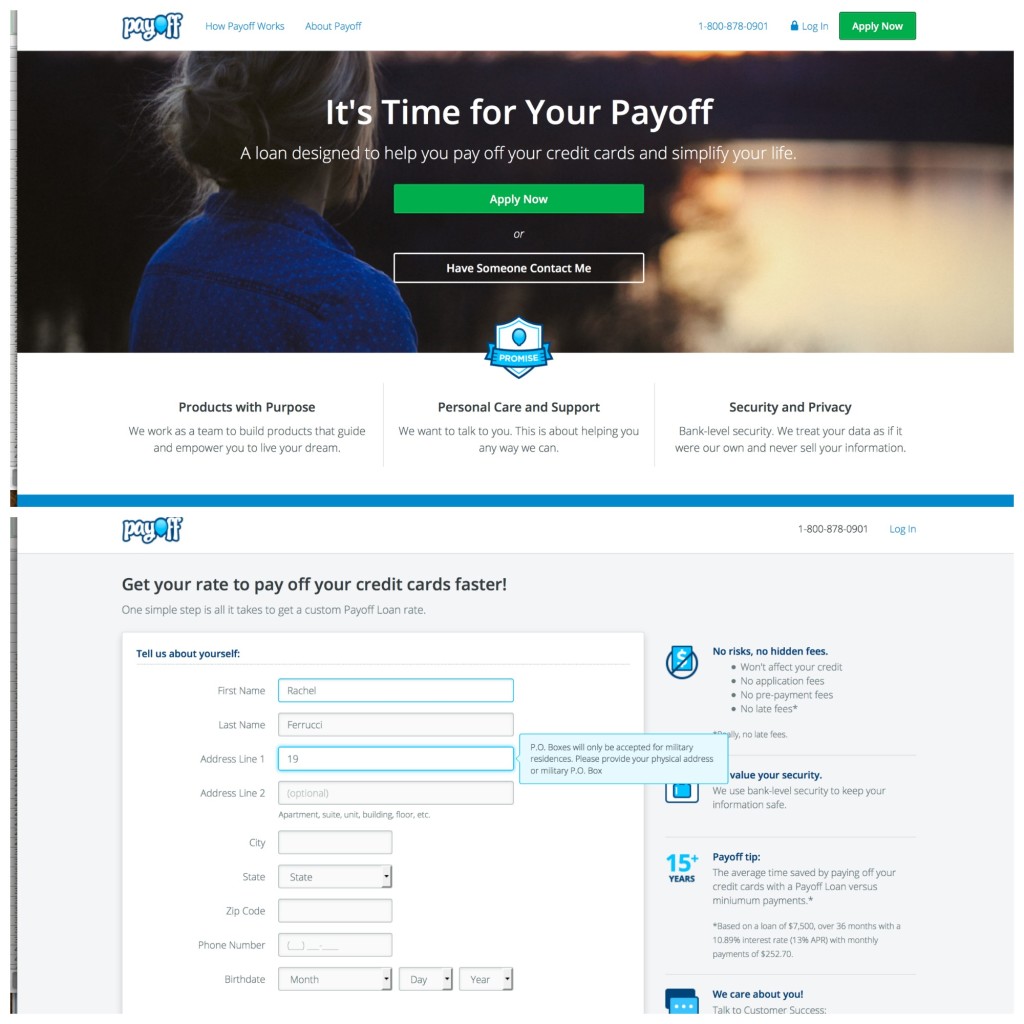

Applying is easy! and it does NOT affect your credit score

Here are the 4 Steps for a Payoff Loan:

- Check your rate – Payoff will ask you for a few pieces of information that will help them create some loan payment choices for you.

- Choose the final payment amount and schedule that best fits you.

- Verify your information, such as identity and income.

- If you’re approved, receive your money and pay off your credit card balances! YES THAT EASY!

Payoff Loan is not yet available in Alabama, Arizona, Colorado, Connecticut, Delaware, Indiana, Iowa, Kansas, Maine, Massachusetts, Minnesota, New Hampshire, New Jersey, Pennsylvania, Texas, and Wisconsin, but we have other ways to help you pay off your credit cards faster. In One of These States? Check out Lift (read on)!

They don’t stop there

Payoff has Customer Success Advocates, a real person. They call you once you’re approved and will triple-check all your information and will be there to help you during the lifetime of your Payoff Loan and beyond.

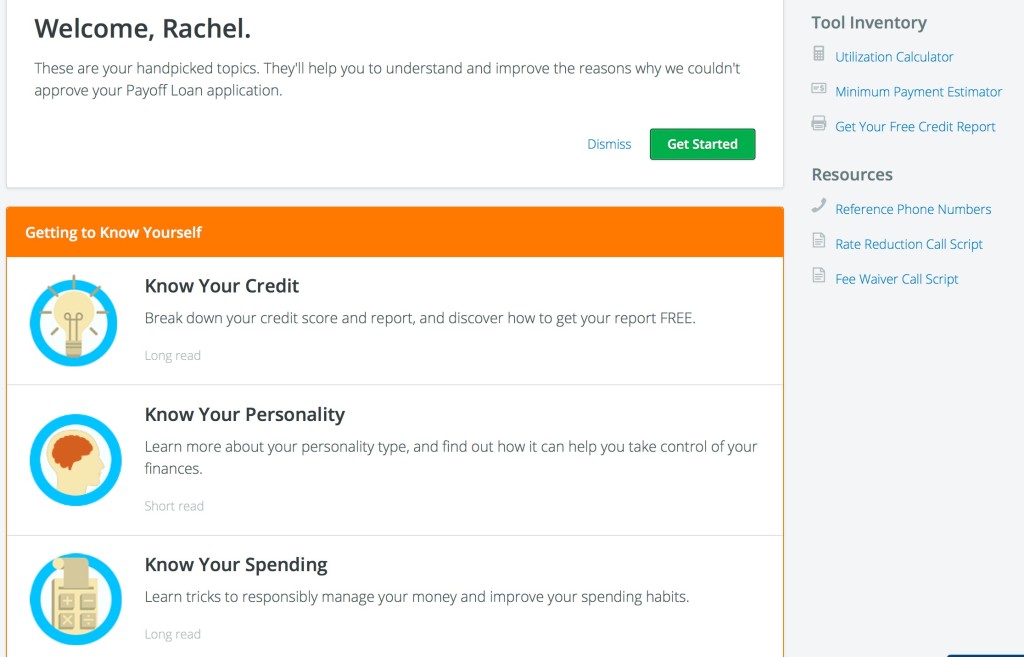

They also have Lift which helps you understand and simplify your money with helpful topics, tools and tips to improve your financial health. You can use Lift even if you don’t get approved or if you live in one of the states they don’t service.

Small changes that you can make to get a fresh financial start

Know your credit score and keep watch. If you see something that doesn’t belong, go through the steps to dispute it. Keep records and follow up!

Get your rate reduced on credit cards- Make a call to your current cards and ask for your rates to be reduced (Rate Reduction Call Script and numbers are on Lift)

Don’t buy coffee in the morning, make it at home and take it with you. Take that extra money each month and throw it on your high interest credit card

Weekends are usually money guzzlers- have a no spend weekend and find fun things to do at home (board games, cards, video games, movies, or be productive and clean out that closet you’ve been meaning to do for months) Take the money you saved and pay the extra on your credit card.

When you go out, leave your credit cards at home, take cash with you. If you have larger bills, you’re less likely to break them for those smaller charges.

Write every dime you spend for one month. You’ll see where your bad habits are.

Stick to your list at the grocery store and make sure to eat before you go! I once spent crazy money because I went when I was hungry.

Let’s talk Lift

Lift is a product designed as a credit and money education platform to help you get control over simple areas of your financial life.

Lift has lots of articles, easy to understand graphics, and even a quiz to help you understand your credit, financial personality, your spending habits, how to cut spending and so much more!

I took the financial personality quiz and since it was just me and a computer I was totally confident answering honestly. I was amazed the results were 95% spot on. There were a few pieces that my husband and I actually joke about, but reading it made me see it’s something I need to work on. We can’t be perfect but being debt free from credit cards is a huge burden off our shoulders.

I would never say to not have any credit cards because I think to have one for emergencies is ok. An emergency doesn’t consist of a new dress but if your car breaks down or your furnace craps out in the middle of a storm you need to have a resource to pay for it.

Learn more about Payoff

Payoff is in the business of empowering people to become more financially healthy and live their dreams.

How will you spend your fun money once your credit cards are paid off? – I’m going to Key West then Hawaii!!

Leave a Reply