Debt can feel overwhelming, but with the right strategies, you can take control and make progress toward financial freedom.

Understanding Your Debt, The First Step Toward Freedom

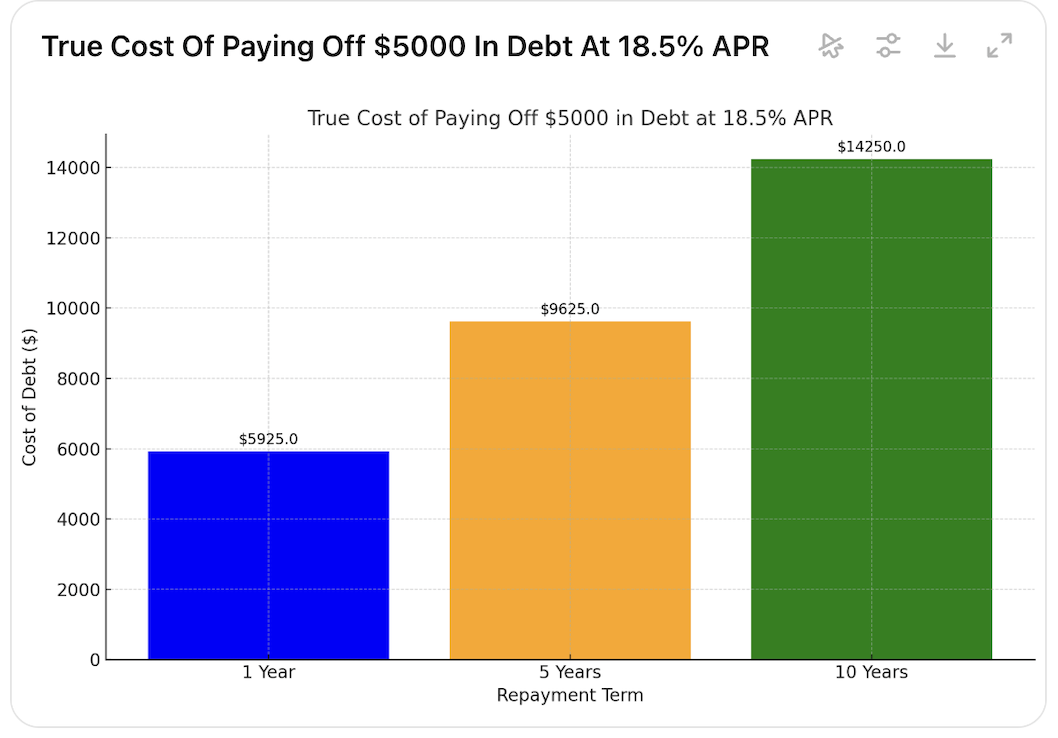

Before you can effectively tackle your debt, it’s crucial to understand how it works and how it impacts your financial health. Different types of debt such as credit cards, student loans, mortgages, or medical bills carry different terms, interest rates, and repayment expectations. High-interest debt, like credit card balances, can grow quickly if not addressed, while lower-interest debt, such as student loans or mortgages, might require long-term strategies. Understanding your debt also means recognizing how interest compounds and how minimum payments often barely chip away at the principal balance. By familiarizing yourself with these details, you can make informed decisions and develop a repayment strategy that minimizes additional costs and maximizes progress toward financial stability. Knowledge is power, and having a clear picture of your debt puts you in the driver’s seat to take control.

Whether you’re dealing with credit card balances, student loans, or other obligations, managing debt starts with a plan. Here are three practical tips to help you tackle your debt effectively:

1. Know Your Numbers, Create a Clear Picture of Your Debt

Before you can tackle your debt, you need to understand the full scope of what you owe. Gather all your loan statements, credit card bills, and other debt documents. Create a list that includes:

- Total balances owed

- Interest rates

- Minimum monthly payments

- Payment due dates

Once you have this information, prioritize your debts. Many people use the avalanche method (paying off high-interest debt first) or the snowball method (paying off smaller debts first for quick wins). Choose the approach that feels most motivating to you and start by allocating extra funds toward your target debt while making minimum payments on others.

2. Create and Stick to a Budget

A budget is your financial roadmap for managing debt. Start by assessing your income and fixed expenses, such as rent, utilities, and groceries. Then, identify areas where you can cut back on discretionary spending to free up money for debt repayment.

- Use budgeting apps to track your spending and identify unnecessary expenses.

- Allocate a specific amount each month to your debt repayment plan.

- Consider adopting the 50/30/20 rule, where 50% of your income goes to necessities, 30% to discretionary spending, and 20% to savings and debt repayment.

By sticking to a budget, you’ll have better control over your finances and be less likely to accumulate new debt.

3. Negotiate and Explore Options for Relief

Don’t be afraid to contact your creditors and negotiate. Many lenders and credit card companies are willing to work with you to create a manageable repayment plan, especially if you’re experiencing financial hardship.

- Request a Lower Interest Rate: If you’ve been a good customer, your credit card company might reduce your interest rate, which can save you money over time.

- Explore Debt Consolidation: If you have multiple high-interest debts, consolidating them into a single loan with a lower interest rate can simplify payments and reduce costs.

- Consider Credit Counseling: Nonprofit credit counseling agencies can help you create a repayment plan and negotiate with creditors on your behalf.

Additionally, keep an eye out for hardship programs, especially if you’re struggling due to unforeseen circumstances like a job loss or medical emergency.

Tackling debt is a journey, but it’s one you can successfully navigate with planning, discipline, and persistence. Remember to celebrate small wins along the way, whether it’s paying off a single credit card or sticking to your budget for a month. Each step brings you closer to financial freedom and the peace of mind that comes with being debt-free.

By knowing your numbers, budgeting wisely, and exploring relief options, you can take control of your finances and build a brighter financial future.

Do you have other tips to share?