How often do you hear someone say they “Have Financial Peace Of Mind”? Most likely not that often. Even when things are tough there are things we can do to have that peace of mind. There have been many times when the holiday season was here that I chose to shop instead of paying a bill or I didn’t have the cash so I charged away. I wanted to make sure my kids got that special present. It may have taken me longer than it should have but I figured out how to avoid the January Financial Hangover with a few simple steps.

How often do you hear someone say they “Have Financial Peace Of Mind”? Most likely not that often. Even when things are tough there are things we can do to have that peace of mind. There have been many times when the holiday season was here that I chose to shop instead of paying a bill or I didn’t have the cash so I charged away. I wanted to make sure my kids got that special present. It may have taken me longer than it should have but I figured out how to avoid the January Financial Hangover with a few simple steps.

- Make your holiday list and stick to it! Just like when you grocery shop, start with your list. Write each person you have to buy for for and do your research before you leave.

- is there someone you can ask to exchange cookies instead of gifts or tell them to get together would be a gift in itself?

- Check all the ads for sales

- Make homemade gifts- Gifts should be from the heart. There are beautiful gifts you can create whether you’re crafty or not and can be less than $5 per person

- Open a separate savings account for your holiday shopping. Whatever the total is at the end of the year is what you stick to. Adding $20 a week can have you over $1000 to shop

Start Now- Give yourself a gift by opening a checking or/and saving

Capital One 360 is giving back to you this season. I know unheard of….. but you heard right!

- Capital One 360 products are designed to save you time and money. From online to their mobile app, Capital One 360 is with customers 24/7.

- Capital One 360 Checking and 360 Savings are fee-free and earn interest.

- Capital One 360 offers remote deposit capture with Capital One 360’s CheckMate tool and make savings a snap with the Automatic Savings Plan.

Don’t get caught up in the hustle and bustle of the holiday season and lose sight of the goals we’ve set to help us achieve financial peace of mind. Stay on track with your finances, Capital One 360 is decking the halls with deals you can bank on, including new account bonuses, referral bonuses and closing cost credits.

- Once the Thanksgiving celebrations are done, be sure to add Capital One 360’s Black Friday Sale to your shopping list. Visit http://clvr.li/cap1bfs to give yourself the lasting gift of financial peace of mind by taking advantage of Capital One 360’s deals on banking, brokerage and mortgage products.

- In addition to taking advantage of deals on banking, brokerage and mortgage products yourself, you can give your friends and family the gift of financial peace of mind by encouraging them to take advantage of the deals and refer them to the sale. If they sign up, you may be eligible for a $40 referral bonus.

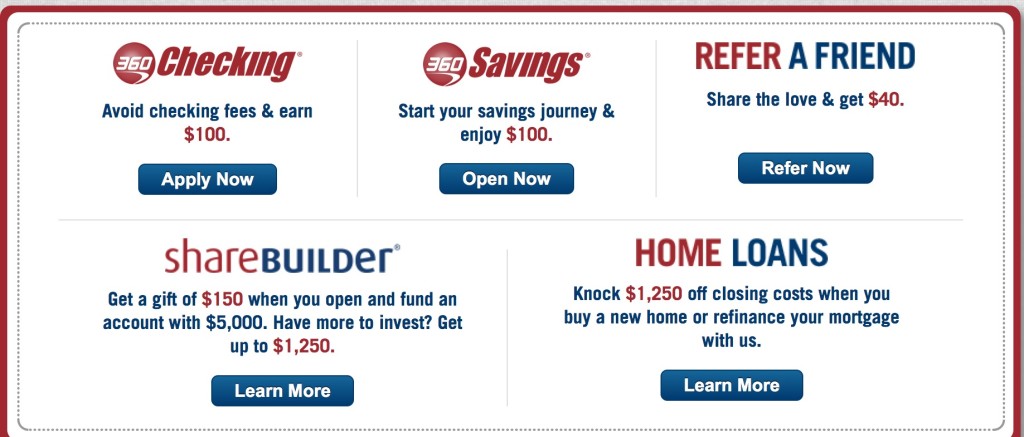

- Deals:

Product Offer Details ShareBuilder Up to $1,250 bonus (tiered offer) - Must be a new ShareBuilder customer

Home Loans $1,250 off closing costs - Must sign up for the loan during the sale period

360 Checking $100 bonus - Must make a $500 minimum initial deposit and make five transactions

- Must be new to 360 Checking

360 Savings $100 bonus - Must make a $1,000 minimum initial deposit

- Must be new to 360 Savings

Refer a Friend $40 bonus per successful referral - For someone to receive the referral bonus, they must be a current customer

- Their friend must meet the minimum initial deposit requirements

- Applies to all accounts

I was selected for this opportunity as a member of Clever Girls and the content and opinions expressed here are all my own.

I certainly use to over spend, but now I think I am better at it. Nothing like spending money you don’t have, no thanks!

The holidays can lead to financial regret, that’s why I always try and stick with a budget.

Those are some good tips. I would also so, if you don’t have the money to buy gifts for everyone, just tell them you can’t participate in the gift exchange this time. You will be that much closer to debt free in January if you don’t spend money you don’t have now.

One thing I don’t do is use credit for the holidays. I still tend to over spend, and might not the best choices, but I know if i used credit I would get myself in way over my head.

It seems like I always overspend for my kids birthdays and Holidays. I really need to do a better job of tracking my spending rather than being surprised.

This will come in so handy. I’ve been buying things randomly and have no clue what I’ve spent or how much I have left to spend! I don’t even remember who I’ve bought WHAT for! I’m pretty disorganized this year!

I’ve recently started getting a lot more organized. This helps me stay on track financially.

I know I’m guilty of going off-list & then grossly over spending. It’s a great reminder to keep a list & be organized. Hopefully there will be no financial hangover in my future.

I try to stay organized and stick to my list. I don’t make any big purchases or do much sale shopping (unless it was on my list.) I haven’t used credit for years.

I think the big key is being organized. I have notebooks and lists for everything.

I really only buy for my daughter, then donate where I can afford, so no January hangover here 🙂

We used to overspend but now we save specifically for the holidays. It really helps lessen the blow of buying presents for 6 children.

I always make a list to keep me organized. We also don’t do sibling adult gifts anymore.

I wish I had financial peace of mind. Just when I think things are caught up something happens. Being more organized would help me tremendously.

I wish I could say we have financial peace of mind, but I we are still working on getting there. I think getting more organized would give me a better edge.

Having a budget during the holidays is a must! Great resource!

We have a separate holiday bank account. Each paycheck, we divert some of the money into this account so that we don’t go overboard come November / December.

We used to overspend and experience that “hangover” but we plan much better now.

I make a budget and try and to stick to it! Love your holiday tips!